Well any business around never wish to pay more than the tax they owe. Mostly owner do not have the knowledge of their cash expenses. They really do not know how to keep track of it. Moreover, legal litigations related to tax deductions is another chapter owners find tough to understand.

Probably client related to schedule C, find tracking of their cash expense difficult. Let us now shed light on how a user can manage or track cutting in QuickBooks self-employed.

Manage Or Track Deductions with QuickBooks Self-Employed for Your Client

Therefore, for making it possible for the user, systemic documentation and gathering of detail data is required for the year. Estimation from tracking may open the user to error.

In addition, if audit is carried out there is quite a possibly that irregularities might subject to heavy penalties to user, as it can be seen the issue is sensitive.

So there is nothing to worry because QuickBooks has come up with yet again amazing feature for its self-employed users. By using smartphones users can keep track for their Mileage and Snap & Store. By using these two-feature users can track, their cash expense ultimately can get effective taxable calculation.

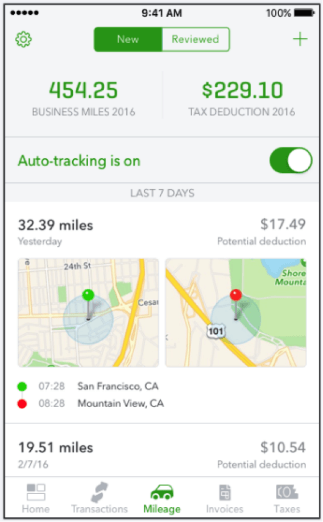

Mileage Tracking

It is extremely vital feature for the business owners and by which they can help track cash expense of business trip. In addition, they can easily do this by using their smartphones or even computer. Each trip can easily be split by swapping left for business and swapping right for user personal. Now it’s so easy for user categorisation of trip is just a touch away.

User can also add the reference about the purpose of the trip, so that in future, if needed user can see which trip was made in what regard, this is the additional feature provided for the user. Once the expense is identifies it is automatically shown to the top side of mileage screen. User can also add business trip expenses manually in case they are not using smart phones. In the section of vehicle deduction in tax, summary report user can easily identify accumulated business miles.

More over this feature has made accountant life very easy they can add these expenses with proper prove in the financial statements. For example, all of the expense will be added to profit and loss account. In case tax authorities ask for the prove owner can provide them with proper documentation and avoid penalties.

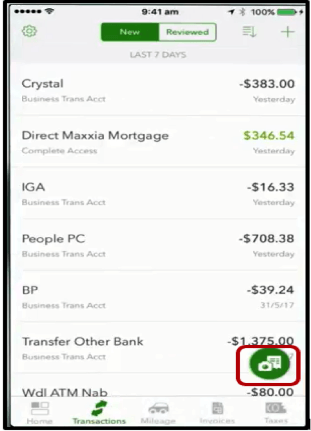

Snap & Store for Cash Expenses

Well for keeping, the track of expense there could not be a better feature than Snap & Store. Tracking cash expense without proper proof and documentation is useless. In order to record that expense proper documentation is needed otherwise authenticity of transaction is subject to problematic and is case of audit, things can get into trouble. Every business owner face difficulties in handling their cash expense. Difficulties include keeping the record of specially tricky and small transactions, which can easily misplaced and of continuous nature, which can be, confuses with other many transactions. Recording of this expense itself can be an issue. Expenses are of many types thus properly categorizing them is bit tricky.

Another issue is the recording of expense are there right date. If owner is keeping, all transaction at one place thing will get in trouble because every expense subject to the different taxation treatment. By placing all at one place tax might get overstate for owner , he might has to pay more and the second scenario is if taxable amount is understated and auditor find out later owner might face penalties.

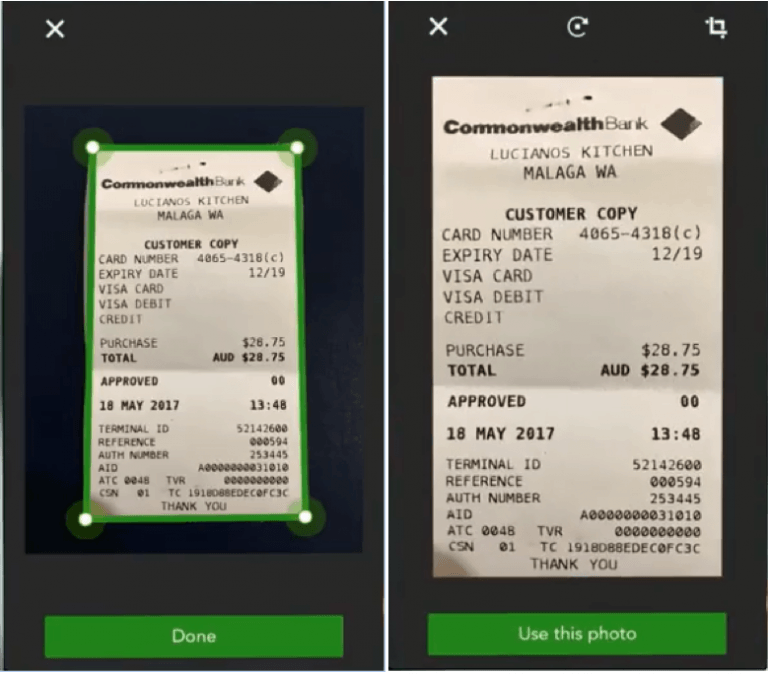

Now when QuickBooks has launched this app the user workload has come down to minimum level. User can just take the picture of receipt then bifurcate it according to their respective category and then save it. Following are the easy step to use this app.

Steps:

- User can click the Snap & Store icon at down the screen.

2. Select camera icon and take the snap of receipt

3. After end of all the procedure, receipt is pop out having the all the details.

Know more:

This feature is one of the latest app available globally and has definitely help out many around. There is no doubt that this app has made the bookkeeping very easy for the owners. Because record keeping is up to date taxation work can easily be carried out and later audit work also run smoothly and effectively. Owner can easily look for it expenses in the categories. Duplications of expenses and overstatement of the expenses is reduce to the minimum level. Preparation of financial statement also get easily and ultimately show true and fair view of business with less mistake.

The End:

Here in the article it is very much clear that these feature is must need for the business owner. It is the demand of the new era accounting. Without these app business owner will lack behind and found themselves in trouble, so these app is highly recommended for the user.

Leave A Comment

You must be logged in to post a comment.