QuickBooks is a highly functional application for bookkeeping and accounting activities. But, it is not free from bugs, which cause inconvenience to users. For example, many users have experienced the error 15241 while dealing with the payroll feature and installing updates. So, how will you manage the error and fix it? Let us provide a guide and talk about the potential factors causing this problem with your software.

Know about the QuickBooks Error 15241

When you are updating the payroll software, you will find this error code.

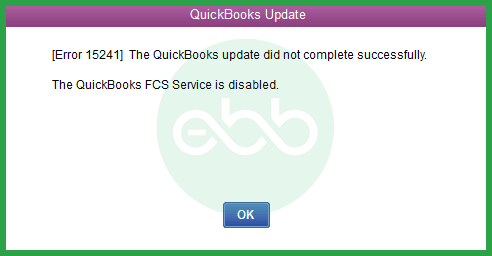

The screen displays that the updating process has not been successful. The displayed QuickBooks FCS Service might be the reason behind it. But, what is FCS? QuickBooks users are familiar with the file copy service that aims to initiate and execute updates on the application. After successful updates of the Intuit QuickBooks servers, the FCS starts its work in the background. However, when the file does not function, you will face the error.

Some users find payroll-related issues while installing and reinstalling the software.

What causes QuickBooks Error 15241?

- Missing or corrupted File Copy Service leads to the error message. Improper installation also results in the same issue.

- Antivirus programs and other security applications in your device affect QuickBooks components’ smooth functioning ability.

- If you have not installed your QuickBooks Desktop software correctly, it will cause errors.

- Windows Registry contains important details about the programs you have installed. If it has any technical bugs, you will find the QB error.

- Compatibility issues also lead to the error code 15241. Your older QuickBooks Desktop version may not be compatible with the new updates.

QB Payroll Error 15241 Symptoms

To detect the technical bug, you have to check out some signs-

- The screen will show a popup window that displays the error code. The active window will crash, and the overall system will stop working.

- Windows will run slowly, and you will get no response from your keyboard inputs.

- The freezing issue with the system is also annoying.

Various ways to solve your QuickBooks Error 15241

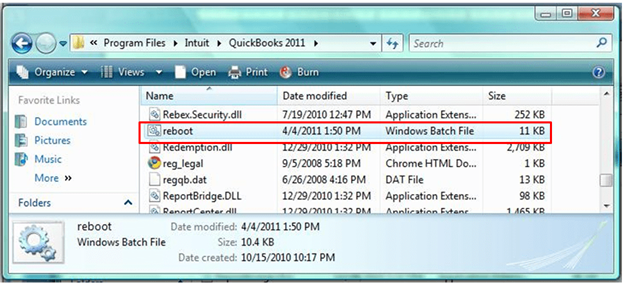

- Run QB Reboot.bat file

- Some users solve the problem by using the QB reboot.bat file.

- Locate the file in the folder related to QuickBooks installation.

- By double-clicking it, you can run the file. When it is done, close the payroll software and restart your device.

- Open the software again and see if this method has resolved the issue.

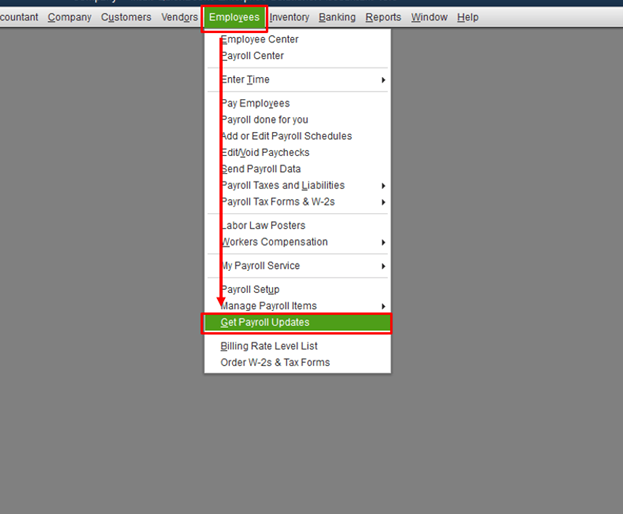

Update QuickBooks Payroll tax table

Updating the payroll tax table is a way to solve QB error code 15241. This solution is applicable to any Windows OS version.

For the troubleshooting process, you need to access the Employees Menu and select – ‘Get Payroll Updates’.

Tick the box beside the ‘download update’ option. Click Update to activate the downloading process. At the end, you will find a popup window about the successful download.

- After inserting the payroll CD into your device, open the payroll window. Access the file option of your QuickBooks software and find ‘Get Payroll Update’.

- The prompt will show an update.dat file that needs to be clicked.

- After this step, you need to redirect the application to the CD’s location. Select the update.dat file and open it. Make sure you have turned off the QB application.

- Choose the updated CD and find the installation file. During the installation process, you must select the right location and payroll update version.

QuickBooks Clean Install software makes this process easier. When the overall process ends, you should check if the error has been resolved.

Call the customer care team for the Payroll Update error

You might have implemented various methods for solving the QB error code15241. However, no trick works for this issue, call the technical assistants of QuickBooks. The professional team will help you remotely and detect the cause of the error message.

So, this brief guide will allow you to fix the QB error code 15241. Rely on experts if you cannot solve the bug in your accounting software.

Leave A Comment

You must be logged in to post a comment.