QuickBooks is one of the renowned accounting software available in the market. This financial software offers multiple accounting features to its users for business growth and expansion. We all know that fixed assets are the building blocks of any company. Without having fixed assets, the company cannot run a business in the long term. Hence it becomes essential to manage them in the firm for financial benefits. However, you must be aware that the value of assets decreases over time recorded in terms of depreciation in the financial books. QuickBooks offers a feature dubbed as Fixed Asset Manager (FAM) that computes depreciation on fixed assets. The feature uses various depreciation methods to compute the value of fixed assets after deducting the scrap value.

Role of QuickBooks Fixed Asset Manager (FAM)

Asset Information

With the help of Fixed Asset Manager (FAM), all the fixed assets of the company are recorded correctly in the books of accounts. Fixed assets show the goodwill of the company in terms of survival and growth.

Journal Recordings

Whenever a new asset is purchased, a journal entry is passed in the books of account. Journal entries are the first step that is done by any accountant while maintaining the books of accounts.

Depreciation

In case if you are not aware, depreciation is the decline in the monetary value of an asset over time. Depreciation is important because the amount is deducted from the original value of an asset, and further, it is beneficial for tax purposes.

Depreciation Report

Fixed Asset Manager ensures that the obsolete value of the asset is deducted. Once the real value is calculated, various depreciation reports and forms are generated.

Download and Install QuickBooks Tool Hub

Download and install QuickBooks tool hub to get rid of unwanted errors, installation problems, multi-user connectivity issues, and fix corrupt company files.

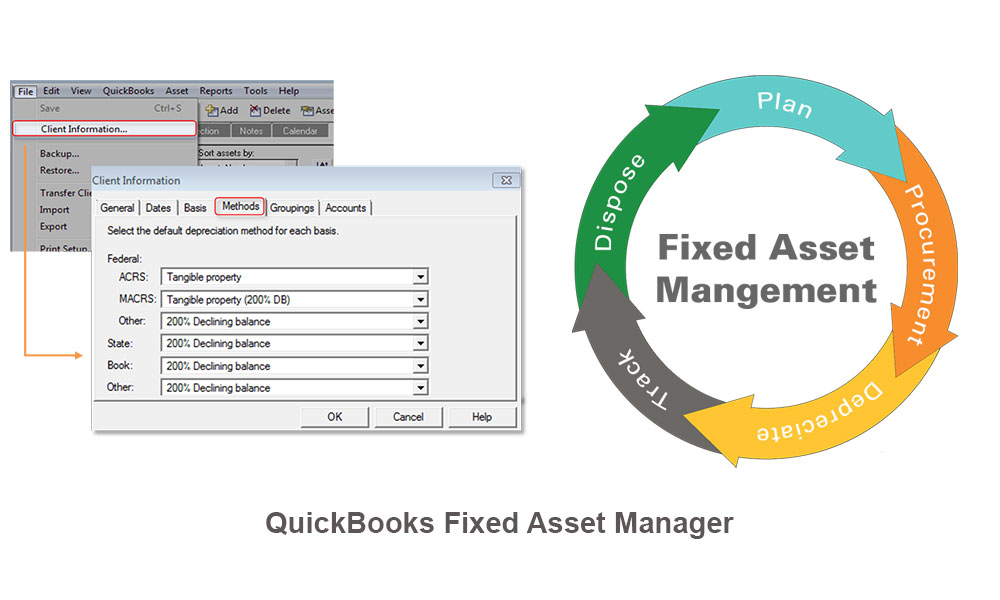

How to Set Up QuickBooks Desktop Fixed Asset Manager (FAM)?

Fixed Asset Manager (FAM) is only available in QuickBooks Desktop Premier Accountant, Enterprise, and Enterprise Accountant. There are five steps involved in setting up the Fixed Asset Manager (FAM), which are-

Setting up Income Tax Form

Depreciation is charged to calculate the real value of an asset. The income tax form is the first step that is done to track asset depreciation through Fixed Asset Manager (FAM).

General Ledger Account

Generally, when depreciation is charged on an asset, journal entries are passed, and ledger accounts are prepared in the books of accounts. Fixed Asset Manager uses minimal account setup where depreciation is posted on the depreciation account and accumulated depreciation account. Apart from this, a fixed asset account is set up in the Fixed Asset Manager (FAM).

FAM Client Wizard

In order to open FAM, go to accountant menu and select manage fixed asset and then choose from various options depending on your business. You will get multiple options like creating a new fixed asset manager client, transfer a prior year fixed asset manager client, and many more.

Adding Asset in Fixed Asset Manager (FAM)

If you have already set up your FAM account in QuickBooks Desktop, you will not follow these steps. However, if you have not set up the account or wish to transfer the information from FAM account to Desktop menu, you will have to manually add an asset from the toolbar menu, including the details and depreciation value.

Asset Synchronization

This is the final step in setting up the FAM account. Since the QuickBooks Desktop and FAM account has separate data files, the programs are synced with each other in either automatic sync or manual sync. Both options can be turned on from the FAM QuickBooks Menu under the asset synchronization option.

Depreciation Methods

The basic work of Fixed Asset Manager Account is to manage assets of the company and charge depreciation to calculate the real value. There are different types of depreciation methods. QuickBooks Fixed Asset Manager uses three different types of depreciation method, which are-

Straight-Line Method

This is one of the easiest methods of calculating depreciation in which an equal amount is depreciated over a period from the original value of an asset.

Declining Balance Method

In this method, it is assumed that the company must get more use of the asset in the initial period. Depreciation Expenses are allocated more to the early stages of an asset in this method.

MACRS (Income Tax Method)

MACRS uses the formula of the double-declining balance method. However, after one year, the depreciation method is switched back to the straight-line method so that assets take a long period to depreciate.

Pre-Defined Reports of Fixed Asset Manager (FAM)

There are different types of pre-defined reports available in the Fixed Asset Manager (FAM). The reports are used for tax purposes and the future growth of the business. In total, there are 19 types of reports which you can use to have a complete overview of fixed assets owned by the company. Some of the major pre-defined reports of the FAM are:

Projection by Category

In this report, assets are grouped as per their category and assigned number for a five-year projection for each asset.

Lead Schedule by Location

In this activity summary of each asset is grouped as per the location. All the assets of the company are sorted by numbers within each group

Assets Acquired in Current Year

As the name suggests, under this report, you get a summary of each asset purchased in the current year. The assets purchased are sorted by purchase date within each group.

ACE Adjustment Calculation

This feature reveals the total ACE adjustment required to compute the tax return for a company. All the assets are grouped and sorted with numbers within each group.

Apart from this, there are sixteen other reports available in the Fixed Asset Manager (FAM). If you wish to know more, you can visit the official website of QuickBooks.

Conclusion

QuickBooks Fixed Asset Manager (FAM) is one of the best features to manage fixed assets of the company. The feature allows to user to charge depreciation on various assets and know the real value. Fixed Asset Manager uses three different and simple depreciation methods. You must note that the FAM feature is only available in QuickBooks Desktop Premier Accountant, QuickBooks Enterprise, and Enterprise Accountant.

For more help and information, please visit QuickBooks Enterprise forum.

Leave A Comment

You must be logged in to post a comment.